Index

What are Americans really searching for when it comes to skincare? Are they after the latest trends, solutions for specific concerns, or simply the best products available?

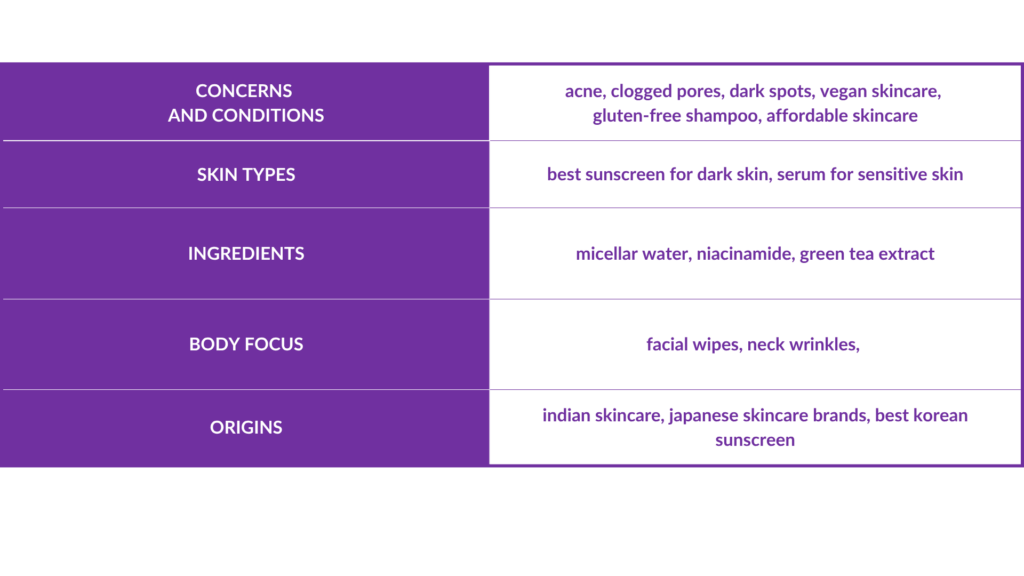

To find out, we looked at real-world search data and analyzed millions of online queries to understand what truly matters to US consumers. Using Listening Mind’s Intent Finder, we selected 100 seed keywords that cover a broad range of products, skin types, ingredients, and origins. By focusing on non-brand keywords, we can see which brands naturally stand out in the minds of consumers, even when those brands are not named directly.

This approach gives us a clear, data-driven snapshot of today’s US skincare market. The findings reveal not only which topics are trending, but also how people search, which brands have strong recognition, and what kinds of information or products consumers want most.

Market overview with Intent Finder

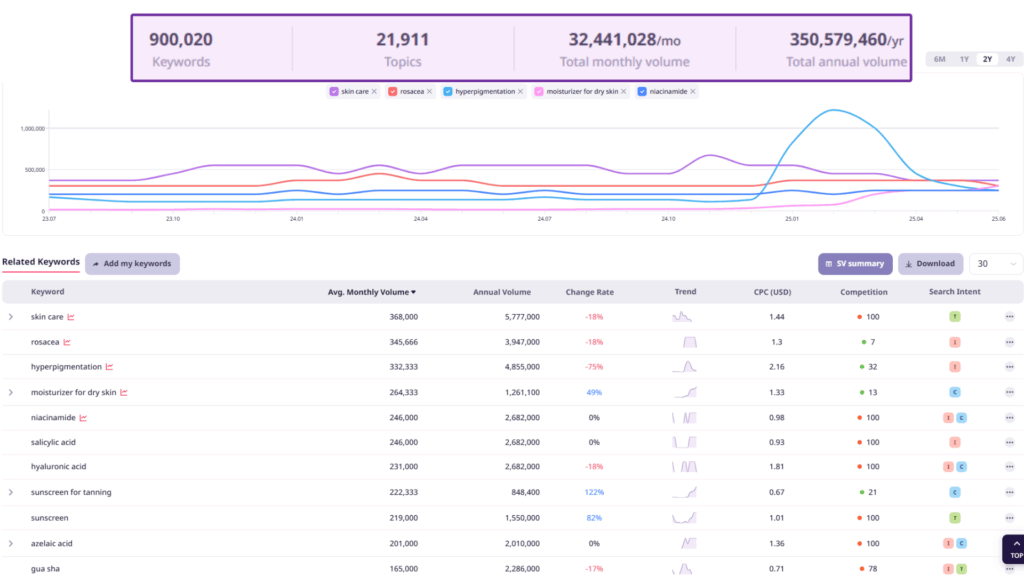

Intent Finder shows us that there were 350 million skincare searches in the USA in the past 12 months and over 32 million average monthly skincare searches. We see that there are just over 900,000 skincare-related keywords, covering over 21,000 topics.

The graph shows a brief spike in searches for hyperpigmentation (332,333/mo), likely due to nostalgia for the 2019 hyperpigmentation meme prompted by concern over a possible Tiktok ban in the United States. Although volume dropped back down, monthly average search volume for hyperpigmentationremains relatively high after the spike, in third place after skincare (368,000/mo) and the skin condition rosacea (345,666/mo).

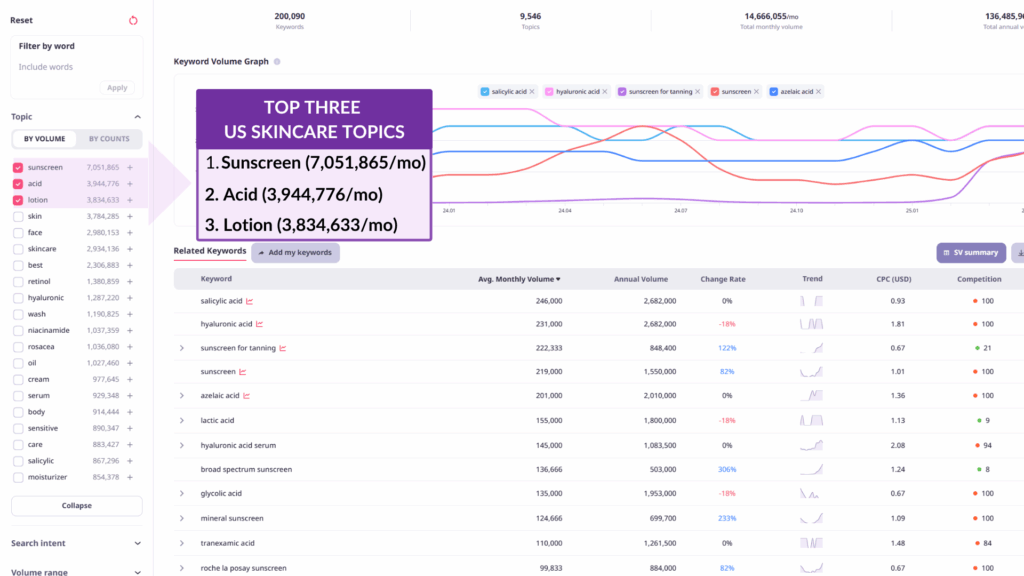

What are the top three most popular skincare topics in the US?

Here, topics include products, ingredients, and skincare concerns. The most searched skincare topics by average monthly search volume are the product topic sunscreen (7,051,865/mo), ingredient topic acid (3,944,766/mo), and lotion (3,834,633/mo).

What general insights can we get from topic categories?

The next step is to look deeper into some of the most popular topics from the product, ingredient, body area, product format, and skin condition categories. Even without looking at individual topics, we can already make some observations.

Some brands are shining when it comes to un-aided consumer awareness

The first thing that immediately stands out is that despite having not used any brand names as seed words for our research, some brands appear in these topic lists. hat’s evidence of high unaided brand awareness for those brands.

- Sunscreen (La Roche-Posay, Neutrogena, Supergoop, Blue Lizard, EltaMD, Joseon Beauty)

- Lotion (Cerave, Aveeno, Nivea)

- Face (Cerave)

- Retinol (Cerave, ROC, The Ordinary)

Consumers want help to find the best products

Next, notice that the sub-topic ‘best’ appears near the top of almost all categories. Consumers want guidance, social proof, and validation so they can find the ideal product without investing too much time. It is important to make it easy for consumers to choose your brand.

Key Skincare Takeaways

- The US skincare market is enormous and fast-changing, with more than 32 million skincare searches each month.

- Sunscreen, acids, and lotions are among the most-searched topics, reflecting what matters most to American consumers.

- Certain brands, like La Roche-Posay, Cerave, and The Ordinary, have built strong recognition even when not directly named in searches.

- The word “best” appears frequently, showing that consumers are looking for trusted recommendations and guidance to simplify their choices.

- Brands that understand these trends and respond with clarity, credibility, and user-focused messaging will be best positioned to earn consumer trust.

In the next article, we take a closer look at the sunscreen category, exploring what drives these searches and how consumers make their decisions.