Index

Why do consumers enter a market?

The essence of digital marketing is understanding why consumers enter a specific category. One of the best methods for uncovering this is Category Entry Point (CEP) analysis, which delivers powerful insights for brand messaging, campaign timing, and product positioning strategy.

In this article, we’ll use ListeningMind on ChatGPT to categorize CEPs based on consumer search behaviors around “baby skincare products” and discuss how marketers can leverage them in practice.

What is ListeningMind on ChatGPT?

ListeningMind on ChatGPT connects OpenAI’s ChatGPT with ListeningMind’s large intent-based search behavior datasets.

✔ No dashboard needed ✔ Just one question ✔ Instant insights.

Anyone can now run market research, CEP analysis, or CDJ tracking directly inside ChatGPT. For brand marketers and planners, this means precise consumer analysis without relying on internal data teams.

🔗 [Try ListeningMind on ChatGPT→]

The power of CEP analysis with search data

Category Entry Point (CEP) refers to the situations, contexts, and reasons that trigger consumers to enter a category. For example, a “baby skincare products” search is rarely just casual interest, it often happens because of specific motivations like:

- Looking for solutions to rashes or sensitive skin

- Searching for gift products

- Comparing brands recommended by pediatricians or influencers

- Researching seasonal care items like sunscreen or winter lotion

ListeningMind’s Cluster Finder automatically analyzes these search pathways and keyword clusters to map them into CEP scenarios. It goes beyond related keywords, capturing entry context and automatically identifying scenarios such as gift-giving, skin concerns, seasonal needs, or postpartum care. Visualization then makes team sharing & decision-making easier.

CEP Analysis Example – “Baby skincare products”

💡Example Prompt

With just one prompt, you can run CEP analysis → generate search-based scenarios → visualize results in HTML.

⌨️ Use the Cluster Finder API to analyze US searches related to “Baby Skincare Products” and categorize CEPs. Group them by representative keywords, monthly search volume, and search sequences. Summarize them into scenarios, then visualize with Plotly and output as HTML.

Key Entry Point Insights

Brand Familiarity Entry Points

Main Keywords:

- Aveeno baby lotion (8,900/m)

- Pipette baby oil (4,400/m)

- Earth Mama baby lotion (2,900/m)

- Honest baby cream (2,400/m)

Scenario: Parents already familiar with specific baby care brands search directly for those names to find official websites, reviews, or trusted retailers.→ Behavior indicates brand recall and consideration-stage exploration.

Evaluation Entry Points

Main Keywords:

- best baby lotion (12,100/m)

- baby skincare products (9,900/m)

- baby skincare guide (2,400/m)

- best baby skincare brand (1,900/m)

Scenario: Parents are researching across brands and types, comparing options for quality, ingredients, or safety.→ Driven by discovery and evaluation before narrowing to a brand.

Retail Context Entry Points

Main Keywords:

- Target baby skincare (6,600/m)

- Walmart baby lotion (4,400/m)

- Amazon baby oil (9,900/m)

- CVS baby cream (1,300/m)

Scenario: Parents enter the category through retailer ecosystems, often seeking convenience, stock availability, or promotions. → Behavior signals lower brand loyalty but strong purchase intent.

Trust & Authenticity Entry Points

Main Keywords:

- Johnson & Johnson baby products (5,400/m)

- Honest Company ingredients (2,900/m)

- Pipette brand (1,900/m)

- Babyganics company (1,300/m)

Scenario: Searches focused on trust, safety, and corporate transparency. → Consumers verify brand ownership, origin, or corporate ethics before purchase.

Problem-Solution Entry Points

Main Keywords:

- baby eczema cream (12,000/m)

- non-toxic baby skincare (17,500/m)

- EWG baby products (6,600/m)

- hypoallergenic baby lotion (4,400/m)

Scenario: Parents search in response to skin concerns or ingredient sensitivities. → Searches express urgency, health focus, and high trust barrier.

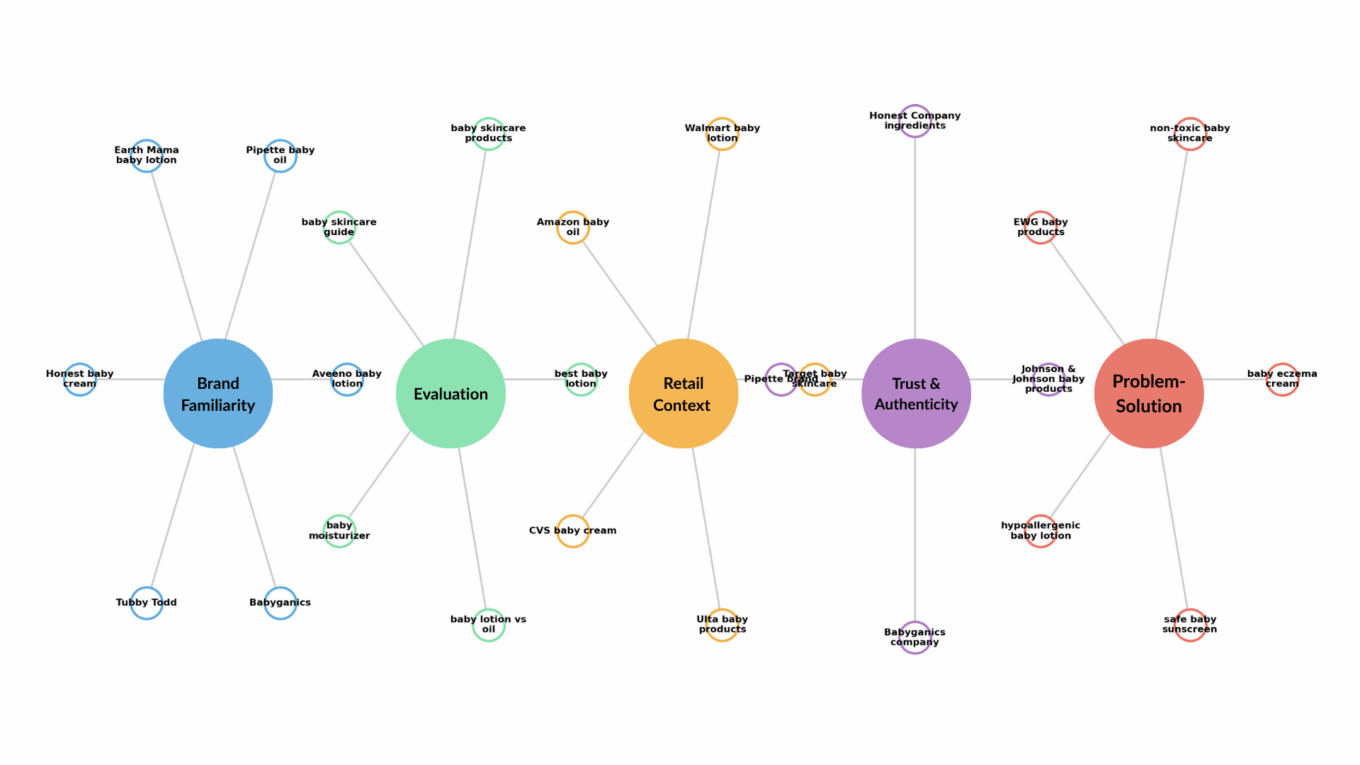

Data Visualizations

Keyword Cluster Visualization by CEP Type – U.S. Baby Skincare (2025)

Five distinct CEP clusters reflect different consumer mindsets: Brand-Driven, Category Comparison, Retailer-Driven, Manufacturer Verification, and Functional Need. Each node represents a high-volume search term within its behavioral cluster.

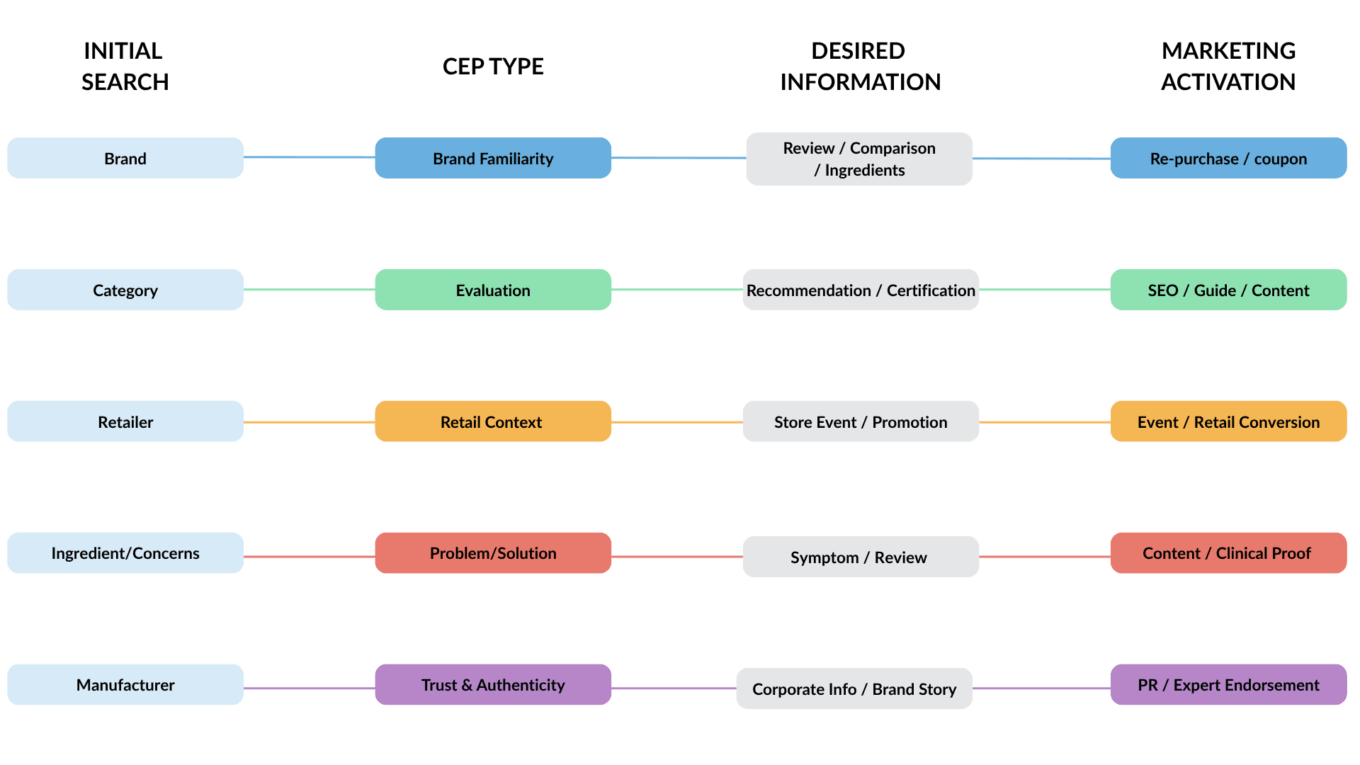

Search Journey & Marketing Action Flow by CEP Type

Each flow illustrates how parents move from initial search intent to brand engagement and final purchase. Distinct paths reflect motivations such as brand familiarity, comparison research, retailer convenience, corporate trust, or functional problem-solving.

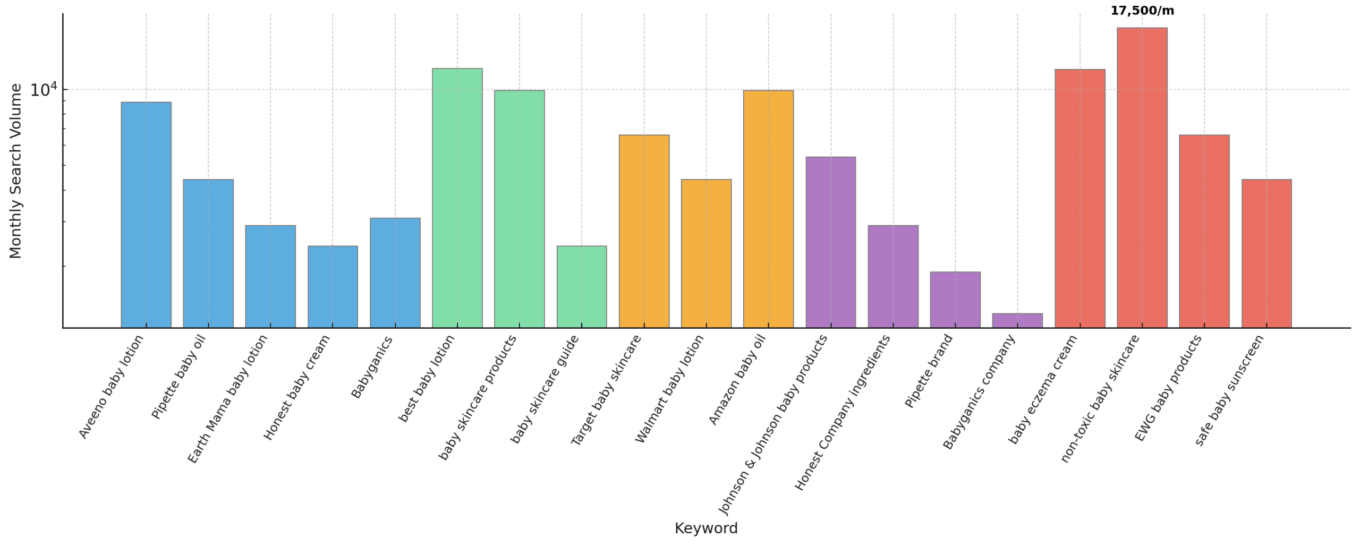

Representative Keywords and Monthly Search Volume by CEP Type

This chart compares monthly U.S. search volumes across top baby skincare keywords, highlighting the relative strength of clean-label, non-toxic, and retailer-driven entry behaviors.

Marketing Action Items by Category Entry Type – U.S. Baby Skincare (2025)

This table outlines appropriate action required to meet the needs of shoppers at each CEP.

| CEP | Representative Keywords | Competing / Reference Brands | Typical Persona Example | Main Search Journey | Marketing Actions |

|---|---|---|---|---|---|

| Brand Familiarity | Aveeno baby lotion, Pipette baby oil, Earth Mama, Honest, Babyganics | Johnson & Johnson, Tubby Todd, Mustela, Weleda | Brand-recognition shopper; repeat buyer | Brand or product search → ingredient/review check → direct purchase | – Strengthen review and UGC content – Loyalty & repurchase coupons – Branded search ads with product bundles |

| Evaluation | best baby lotion, baby skincare products, baby skincare guide | Honest, Pipette, Baby Dove, Burt’s Bees | First-time parent comparing options | Category-level search → certification/safety check → brand selection | – Category SEO optimization – Certification & ingredient-focused content – Comparison charts and influencer explainers |

| Retail Context | Target baby skincare, Walmart baby lotion, Amazon baby oil | Walmart, Target, Amazon, CVS, Ulta | Convenience-driven parent; prefers known stores | Retailer + product search → deal/event discovery → in-store or online purchase | – Retail-specific ad campaigns – In-store events or sampling – Sponsored placements and shopper ads |

| Trust & Authenticity | Johnson & Johnson baby products, Honest Company ingredients, Pipette brand | Procter & Gamble, The Honest Co., Unilever | Cautious researcher validating brands | Manufacturer or ingredient check → expert/press content → purchase | – Corporate storytelling & transparency content – B2B or ingredient-based marketing – PR outreach and expert collaborations |

| Problem-Solution | baby eczema cream, non-toxic baby skincare, EWG baby products, safe baby sunscreen | Eucerin Baby, Vanicream, Thinkbaby, CeraVe Baby | Concern-driven parent focused on relief and safety | Condition-driven search → dermatologist reviews → purchase decision | – Dedicated landing pages by concern – Expert/dermatologist Q&A – Clinical data and safety proof visuals |

Key Takeaways

Each CEP represents a distinct entry mindset:

- Brand Familiarity Entry Points shoppers convert quickly through familiarity.

- Category Comparison users need education and reassurance.

- Retailer-Driven parents respond best to promotions and events.

- Trust & Authenticity Entry consumers demand trust and transparency.

- Problem-Solution Entry Points require proof, empathy, and expertise.

Parents don’t enter the “baby skincare” category uniformly – they enter through emotionally distinct, context-driven gateways. Brands must adapt communication by CEP type, leveraging data-driven personalization and cross-channel storytelling to convert intent into purchase.

Experience Real CEP Analysis Now

No more lengthy reports or complex settings—just one prompt line gives you practical insights instantly. ListeningMind on ChatGPT is the starting point for data analysis that anyone in the field can use.

💡Copy the Real-World Prompt

⌨️ Use the Cluster Finder API to analyze US searches related to “Baby Skincare Products” and categorize CEPs. Group them by representative keywords, monthly search volume, and search sequences. Summarize them into scenarios, then visualize with Plotly and output as HTML.

🔗 [Try ListeningMind on ChatGPT→]

💡Dive Deeper with our Prompt Library

| Objective | ⌨️ Example Prompt | Expected Output |

|---|---|---|

| Understand the Consumer Journey | Map the Customer Decision Journey (CDJ) for U.S. consumers searching for baby skincare products. Highlight key drop-off points and brand touchpoints by stage. | Stage-by-stage journey from awareness → research → purchase, with insights into search behaviors and brand influence. |

| Segment by Intent | Segment baby skincare products shoppers by search intent (research vs purchase). Summarize motivations and next likely actions. | Clear intent-based segmentation showing early-stage information seekers vs ready-to-buy consumers. |

| Visualize Search Flow | Show how parents move from general baby skincare products searches to brand or product queries — visualize this as a search journey flow. | Interactive flow chart mapping real keyword transitions and decision patterns. |

| Identify Rising Trends | Identify the top-rising baby skincare products–related keywords in the U.S. over the past 90 days and group them by emotional intent (safety, gifts, seasonal care). | List of trending keywords with emotional segmentation, signaling emerging opportunities for campaigns. |

| Compare Category Momentum | Compare Google Trends growth between non-toxic baby skincare products and organic baby skincare products over the past year. | Trend chart showing comparative growth and seasonal peaks for two subcategories. |

| Track Emerging Entry Points | Find new keywords that have entered the baby skincare products cluster since six months ago. Highlight emerging entry points. | Discovery of new search terms and behaviors reflecting market evolution or innovation trends. |

| Benchmark Brand Performance | Compare the search pathways of Aveeno Baby and Pipette Baby — identify overlapping and unique CEP triggers for baby skincare products. | Comparative map showing each brand’s entry contexts and behavioral overlap across CEPs. |

| Find CEP Leaders | Show which brands dominate the functional need CEP (eczema, hypoallergenic, sensitive skin) within the baby skincare products category in U.S. searches. | Brand ranking table within the functional need cluster — ideal for competitive positioning. |

| Link CEPs to Messaging | For each CEP type in baby skincare products, recommend messaging angles and ad copy themes that match the emotional entry context. | Marketing message framework (tone, emotion, proof points) aligned with each CEP mindset. |

| Generate Influencer Briefs | Create influencer brief ideas for the functional need cluster in baby skincare products — focus on empathy, expertise, and dermatologist trust. | Influencer or content creator campaign ideas tailored to functional or dermatological needs. |

| Connect Categories | Find related CEP clusters linking baby skincare products to postpartum care or baby gift sets. Identify cross-category entry points. | Cross-category insights showing overlapping motivations and new collaboration angles. |

| Analyze Seasonal Patterns | Analyze seasonal changes in baby skincare products searches and identify which CEPs rise in winter vs summer. | Seasonality chart showing how different needs (dryness, sunscreen, gifting) fluctuate by quarter. |