Index

Introduction

Running a beauty brand competitive analysis has traditionally required weeks of manual research, fragmented data collection, and labor-intensive synthesis across multiple sources. With ListeningMind on ChatGPT, marketers can now generate a complete, data-driven market map — including search volume, brand competition, and consumer perception — in just minutes.

Using real-time search data, this approach reveals how brands are positioned in the U.S. color cosmetics market, combining speed, accuracy, and depth that surpass traditional research methods. In this article, we illustrate the process through a comparison of Rare Beauty, Fenty Beauty, Glossier, and e.l.f. Cosmetics, showing how instant analysis can power faster, insight-led decision making. This method doesn’t just accelerate analysis — it reshapes how marketers approach market intelligence altogether.

🔹 Analysis Overview

Objective: Understand the competitive structure and consumer perceptions within the color cosmetics category in the U.S. using real search data.

Tools Used: ListeningMind API + ChatGPT (Learn more about ListeningMind on ChatGPT →)

Data Source: Google Search Data (U.S., 2025)

These data sources together form the foundation of a transparent, evidence-based view of brand competition.

Brand Competition Mapping (Search-Based Market Structure)

Prompt Example

Category: Beauty / Cosmetics

Brands: Rare Beauty, Fenty Beauty, Glossier, e.l.f. Cosmetics

Country: United States

Goal: Generate a competition map based on search volume, share, and competitive intensity.Using the ListeningMind

keyword_info

API, we gathered each brand’s search volume, CPC, trend direction, and competition index to visualize their relative market positions.

📊 Key Insights

Summary of Market Dynamics

- Market Leader: Rare Beauty now surpasses Fenty Beauty in average search momentum, with a +48% YoY growth trend. Its success is fueled by authentic storytelling and viral TikTok “no-makeup” looks.

- Steady Performer: Fenty Beauty retains a dominant base of consistent searches (~150K/month) and remains a benchmark for inclusivity and foundation shade range, though growth has plateaued.

- Brand in Transition: Glossier continues to command high search volume (177K) but shows a 17% decline. Consumer interest is shifting from minimalism toward hybrid skincare-makeup.

- Mainstream Challenger: e.l.f. Cosmetics exhibits strong price competitiveness and heavy YouTube influencer presence, yet search volume has fallen 45%, suggesting post-pandemic cooling after viral campaigns.

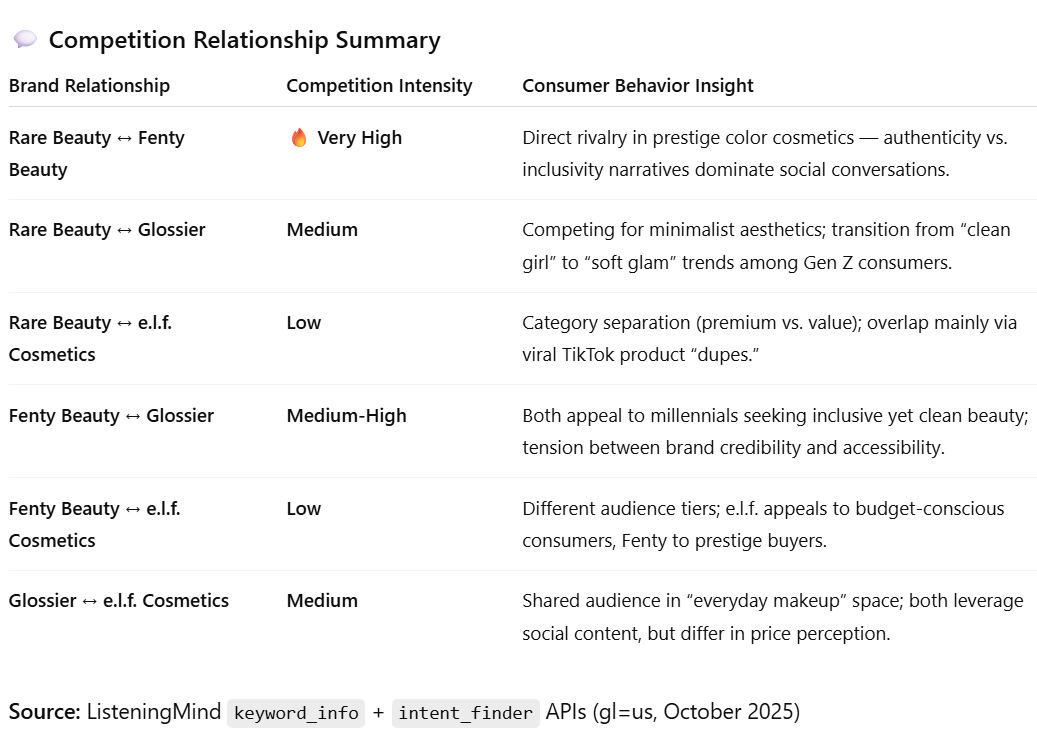

Brand Association Analysis (Consumer Perception Structure)

By analyzing related search terms and co-search patterns, we uncovered how consumers mentally associate each brand within the color cosmetics category.

Prompt Example

Based on the preceding and following search terms for these brand keywords,

analyze the factors related to consumer perception and associations.

Brand Association Comparison & Integrated Perception Structure

Perception Structure Summary Comparison

📊 Key Insights

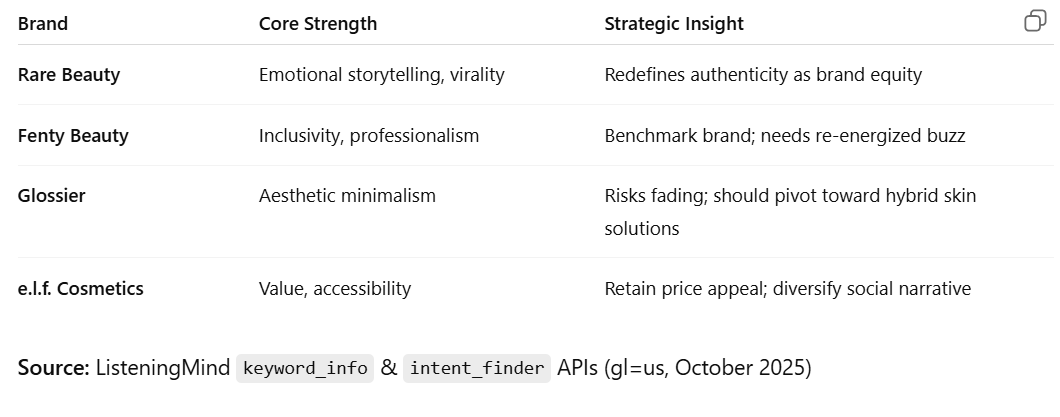

- Rare Beauty dominates Emotional Appeal and Social Buzz, fueled by authenticity and TikTok engagement.

- Fenty Beauty anchors Professionalism and Inclusivity, sustaining a strong loyal base.

- Glossier maintains Minimalist Aesthetic appeal but shows moderate emotional resonance and declining virality.

- e.l.f. Cosmetics leads in Affordability and Practical Use, resonating with value-conscious Gen Z consumers.

- Together, these results reveal a clear segmentation between emotion-driven brands and performance-driven brands — a defining dynamic in the 2025 U.S. beauty market.

Together, these results reveal a clear segmentation between emotion-driven brands and performance-driven brands — a defining dynamic in the 2025 U.S. beauty market.

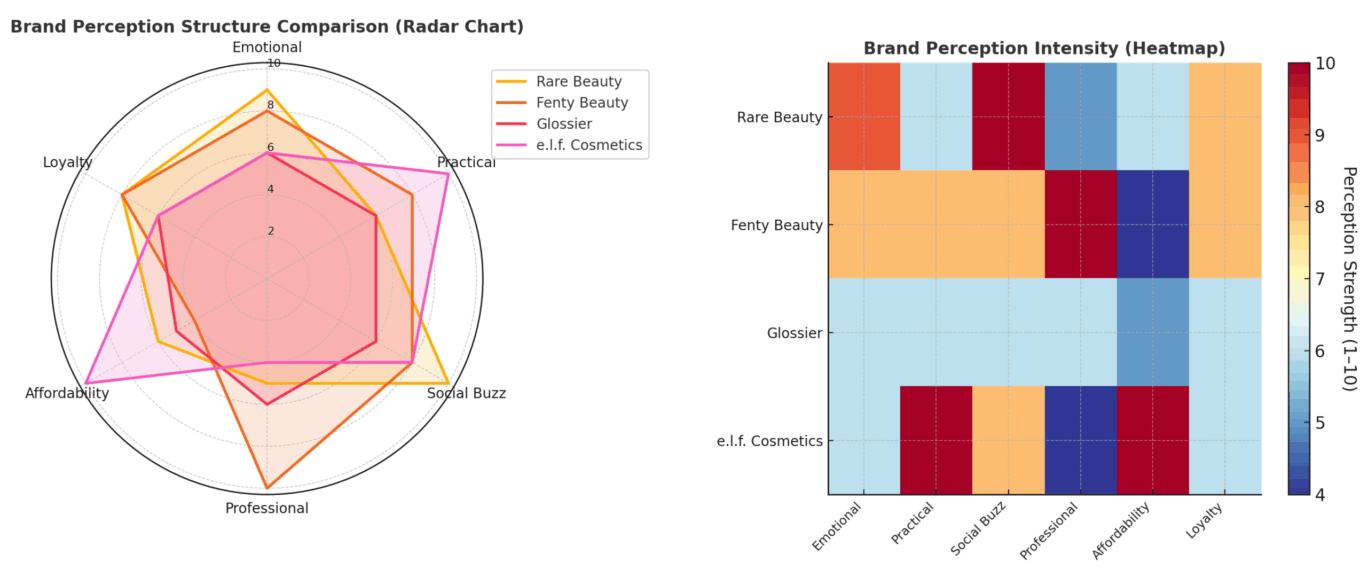

Visualization (Brand Positioning & Perception Intensity)

The competitive and perceptual structures above can be visualized to better understand each brand’s position.

Prompt Example

Visualize the brand competition map and consumer perception analysis results.Brand Perception Structure (radar chart), Brand Perception Intensity (Heatmap)

🔹 Right: Radar chart

Shows each brand’s perception balance across six dimensions — Emotional, Practical, Social Buzz, Professional, Affordability, and Loyalty.

- Rare Beauty dominates Social Buzz and Emotional Appeal (high virality + authenticity).

- Fenty Beauty scores highest in Professionalism and Loyalty.

- Glossier maintains moderate scores across all dimensions, signaling balanced but waning differentiation.

- e.l.f. Cosmetics leads in Affordability and Practicality, reflecting strong value positioning.

🔹 Right: Heatmap

Quantifies the intensity (1–10) of consumer perception strength by brand and axis.

- Warmer colors = stronger association

- Cooler colors = weaker association

Source: ListeningMind

cluster_finder

+

intent_finder

APIs (gl=us, October 2025)

Summary of Brand Takeaways

The table below summarizes each brand’s strengths and strategic implications based on search and perception data.

Conclusion

Traditional competitive analysis often takes weeks — gathering data, cleaning it, and interpreting fragmented insights across reports and dashboards. ListeningMind on ChatGPT compresses that entire process into a few targeted prompts, transforming what once required multiple tools and teams into a single, real-time workflow.

In just minutes, marketers can now map competition, visualize brand positioning, and uncover consumer perception drivers — all powered by actual search behavior from the U.S. beauty market. The result isn’t just speed — it’s strategic clarity. ListeningMind bridges the gap between data overload and insight clarity, enabling marketing and insight teams to focus on strategic action instead of data wrangling.

Whether you’re tracking category trends or evaluating a brand’s emotional resonance, ListeningMind on ChatGPT lets you move from question to answer — from analysis to visualization — at unprecedented speed. As AI transforms market intelligence, ListeningMind on ChatGPT stands at the forefront — delivering competitive clarity at the speed of conversation.

🔗 Learn more about ListeningMind on ChatGPT →

🔗 Start a 1-week ListeningMind Trial Free

🔖 References

ListeningMind APIs Used:

-

keyword_info(search metrics, CPC, competition) -

intent_finder(consumer associations) -

association_map(perception network visualization)

Data Source: Google Search Data — United States (as of October 2025)